Tax Bracket 2025 Calculator

BlogTax Bracket 2025 Calculator. Knowing your tax bracket can help you make smarter financial decisions. Estimate your 2025 tax refund or taxes owed, and check federal and provincial tax rates.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers. When your income jumps to a higher tax bracket, you don’t pay the.

2025 Tax Bracket Calculator Tiff Anabelle, If you need to access the calculator for the 2025 tax year and the 2025 tax return, you can find it here. And is based on the tax brackets of 2025 and 2025.

Tax Brackets 2025 Nj Rena Valina, 2025 income tax bracket calculator. These rates apply to your taxable income.

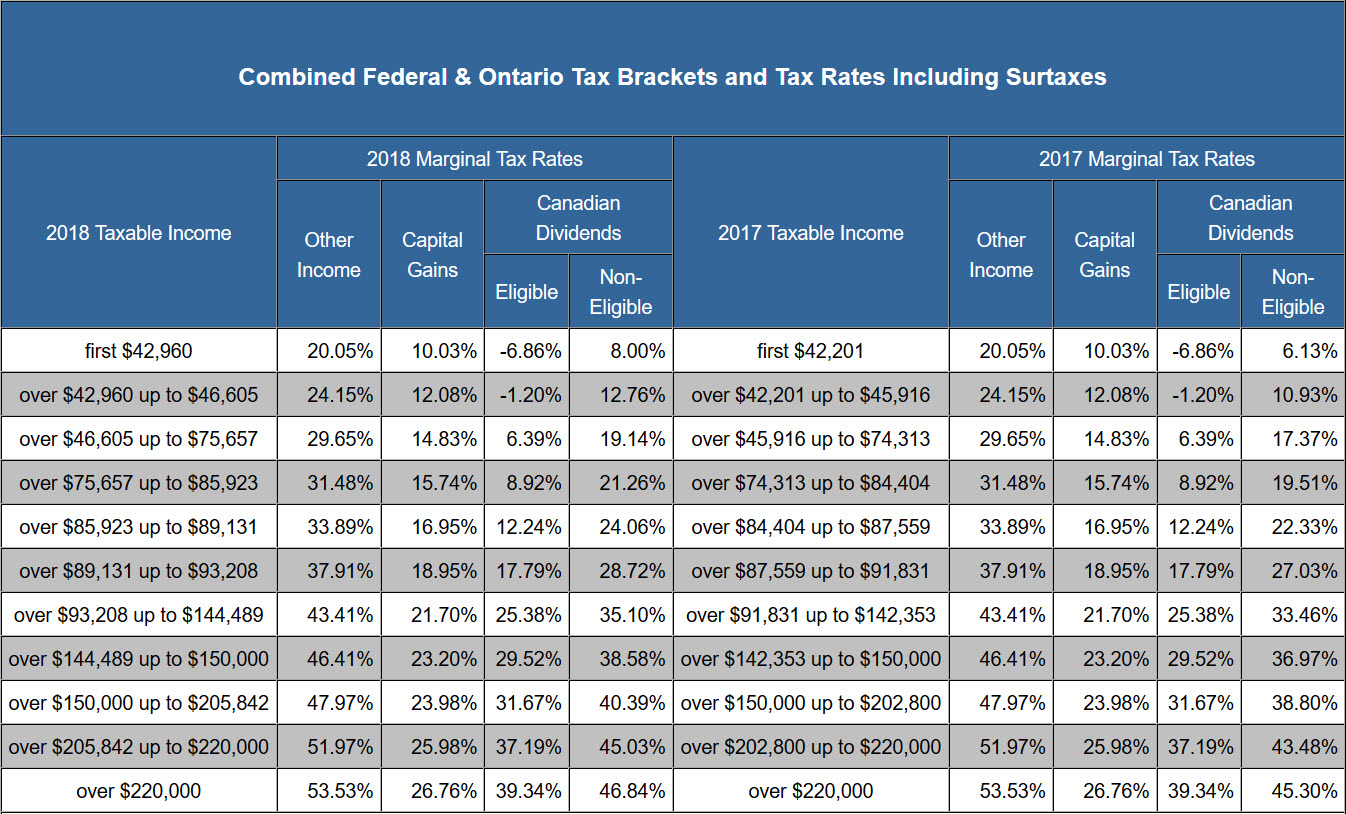

2025 Tax Brackets Ontario Abbie Shanda, Taxact’s free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Up to $23,200 (was $22,000 for 2025) — 10%;

2025 Tax Calculator Usa Helge Fernande, 10%, 12%, 22%, 24%, 32%, 35% and 37%. The irs says now is a.

April 2025 Tax Brackets Calculator Adorne Lilian, The top 1 percent’s income share rose. Tax classes (steuerklasse) in 2025.

April 2025 Tax Brackets Calculator Adorne Lilian, For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax. For a more detailed assessment, including other deductions or specific tax.

Tax Brackets For Taxes Due 2025 Nj Rica Moreen, Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe. Tax classes (steuerklasse) in 2025.

Tax Brackets For Taxes Due 2025 Nj Rica Moreen, When your income jumps to a higher tax bracket, you don't pay the. The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in canada.

Tax Brackets 2025 South Africa Companies Shani Leonora, The income tax calculator estimates the refund or potential owed amount on a federal tax return. Use this service to estimate how much income tax and national insurance you should pay for the current tax year (6 april 2025 to 5 april 2025).

Taxact’s free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax.